1.104.222

kiadvánnyal nyújtjuk Magyarország legnagyobb antikvár könyv-kínálatát

VISSZA

A TETEJÉRE

JAVASLATOKÉszre-

vételek

In Search of Shareholder Value

Managing the drivers of performance

| Kiadó: | Pitman Publishing |

|---|---|

| Kiadás helye: | London |

| Kiadás éve: | |

| Kötés típusa: | Fűzött keménykötés |

| Oldalszám: | 292 oldal |

| Sorozatcím: | Prince Waterhouse |

| Kötetszám: | |

| Nyelv: | Angol |

| Méret: | 24 cm x 16 cm |

| ISBN: | 0-273-63027-X |

| Megjegyzés: | Fekete-fehér ábrákkal. |

naponta értesítjük a beérkező friss

kiadványokról

naponta értesítjük a beérkező friss

kiadványokról

Előszó

TovábbFülszöveg

•'/.-WiVivl;

: ; I I

I r I

IV)

1 v/ti Tn y I'I ' V' I'' I I ' I '(.

l' ' ¦ i p i •

(¦I'I ''ll'l 'i !, 'M ' '

mm

'ill ii'.:.

i^vl'ii i j,

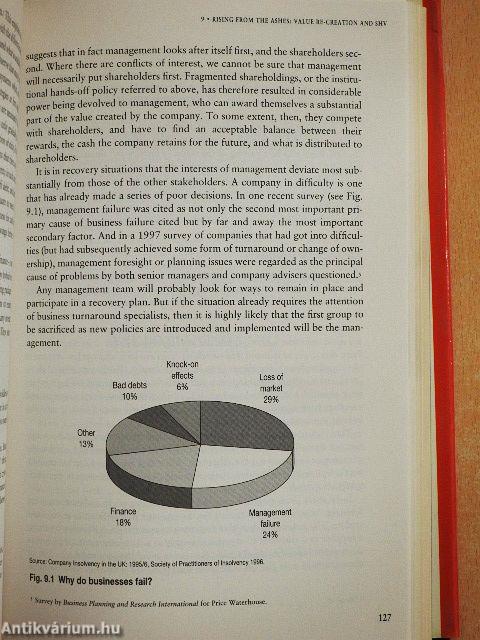

Ihy is shareholder value so important? Any investor putting money into your company will expect a financial return as good as, if not better than, what they can obtain elsewhere. With widespread deregulation, the expansion of equity markets and the availability of sophisticated imancial information for investors, there is a new global imperative for businesses and managers alike; maximize value for your shareholders.

When the market looks at a firm's performance, profit and loss statements and price/earnings ratios no longer convey enough information, and with institutional investors under pressure to consistently secure the best returns available, they are increasingly looidng to assess the future value of an investment. Hence the attention now paid to cashflows and the 'cost of capital' — the idea that companies have to... Tovább

Fülszöveg

•'/.-WiVivl;

: ; I I

I r I

IV)

1 v/ti Tn y I'I ' V' I'' I I ' I '(.

l' ' ¦ i p i •

(¦I'I ''ll'l 'i !, 'M ' '

mm

'ill ii'.:.

i^vl'ii i j,

Ihy is shareholder value so important? Any investor putting money into your company will expect a financial return as good as, if not better than, what they can obtain elsewhere. With widespread deregulation, the expansion of equity markets and the availability of sophisticated imancial information for investors, there is a new global imperative for businesses and managers alike; maximize value for your shareholders.

When the market looks at a firm's performance, profit and loss statements and price/earnings ratios no longer convey enough information, and with institutional investors under pressure to consistently secure the best returns available, they are increasingly looidng to assess the future value of an investment. Hence the attention now paid to cashflows and the 'cost of capital' — the idea that companies have to earn a certain level of returns to justify the use of the capital that is tied up in their enterprise. More than ever, mastering valuation has become an essential skill for managers whenever they make strategic decisions.

From this insight. In Search of Shareholder Value moves on to identify the key 'value drivers' and examines how risk can be calculated. Part I of the book also looks at the technicahties of Shareholder Value Added (SVA), Cash Flow Return on Investment (CFROI), and Q.ratios and how they might be used to evaluate company strategy and the use of resources.

Shareholder value is at the heart of value-based management, the subject of Part II. Here we see how the framework of SHV can integrate the core business processes of creating, preserving and realizing value. This analysis of a company's constituent parts and how they are creating or destroying value is followed by action — aligning them with SHV goals — and communication with the market. The book also examines how the achievement of SHV goals can be rewarded appropriately as these challenges are met

In a series of unique applications of shareholder value, the book develops these techniques and shows how they can be customized and deployed across a range of international markets and specific sectors - from pharmaceuticals to banking. The authors then outline the first application of SHV to the special circumstances of mergers and acquisitions and value re-creation in underperforming businesses.

Finally, the book outlines the enhanced service of 'value reporting' (VR) that the company of the future will require. Focusing on the key performance metrics of shareholder value, VR will combine three areas of accounting to bring in a new era of transparency and value creation.

In Search of Shareholder Value is a powerful blueprint for managing the linlf between strategy and share price.

H i i/. , ,'|l|. ,i

"In Search of Shareholder Value accumulates our global experience of helping companies to enhance shareholder value. CEOs, CEOs and other senior executives tell us that this continues to be a key priority. I believe this book demonstrates our commitment to contributing to their success."

Jim Schiro, CEO, Price Waterhouse

"Creating shareholder value is the objective of every company today. Price Waterhouse's experience in helping companies on this continuous journey is invaluable. Getting started on the process is sometimes mysterious. This book can help you begin the journey."

Steven S. Reinemund, Chairman and CEO, Frito-Lay Inc.

"Traditional accounting methods do not allow proper assessment of intrinsic value of stocks. Cash is what counts! Value-based analysis is essential for investors to evaluate potential opportunities, and for corporates to run their business more efficiently. Price Waterhouse's book should contribute to make these necessary changes happen." Francois Langlade-Demoyen,

Director of European Strategy, Credit Suisse First Boston

"Working with Price Waterhouse to analyze the value of our business provided us with the evidence to demonstrate empirically our executive team's views. Value performance will assist us to focus our corporate and divisional plans to balance the value components of risk, return and growth."

Jim McGuinness, Finance Director, UAP Provincial

"The pursuit of value-creating opportunities is nothing new. The shareholder value mindset defined in this book provides the route for this pursuit."

Roger Mills, Professor of Accounting and Finance, Henley Management College

"The process is synergistic. Creating value for one stakeholder enhances value for all other stakeholders."

Virgil Stephens, CFO, Eastman Chemical Co.

"For us there cannot be any doubt that creating and adding value is the ultimate aim of all business enterprises."

Dr Klaus-Jürgen Schmieder, Chief Financial Officer, Hoechst AG

How can you manage the all-important link between strategy and share price? The answer lies in value. When business people and investors talk about value, their focus is increasingly on shareholder value.

In Search of Shareholder Value examines the whole philosophy of value creation, explains the key measures of shareholder value and delivers a practical and robust framework for their application in driving company performance.

Drawing on the experiences of Price Waterhouse's worldwide network of companies and clients, this book will help business leaders, managers and finance officers use the drivers of shareholder value to identify where their own businesses are strong and weak in the creation of shareholder value; to analyze the trade-offs between risk and return; and to actively build value for shareholders with every corporate decision. Vissza

Témakörök

- Közgazdaságtan > Menedzserképzés, marketing

- Közgazdaságtan > Számvitel, elemzés

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Menedzserképzés, marketing

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Számvitel, elemzés

- Közgazdaságtan > Pénzügy > Értékpapírok

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Pénzügy > Értékpapírok