1.103.822

kiadvánnyal nyújtjuk Magyarország legnagyobb antikvár könyv-kínálatát

VISSZA

A TETEJÉRE

JAVASLATOKÉszre-

vételek

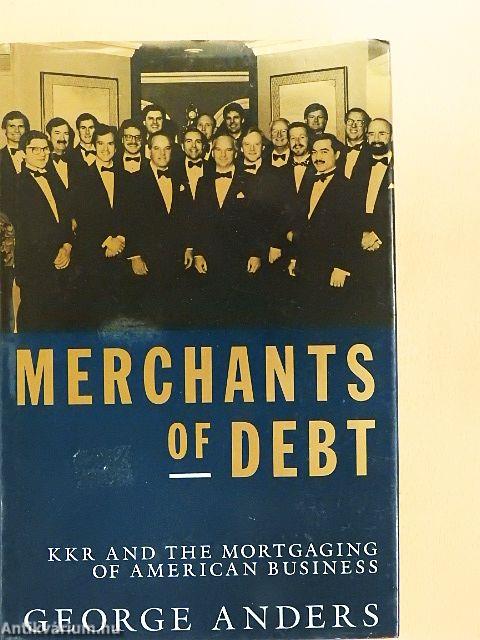

Merchants of Debt

KKR and the Mortgaging of American Business

| Kiadó: | Jonathan Cape |

|---|---|

| Kiadás helye: | London |

| Kiadás éve: | |

| Kötés típusa: | Varrott keménykötés |

| Oldalszám: | 328 oldal |

| Sorozatcím: | |

| Kötetszám: | |

| Nyelv: | Angol |

| Méret: | 24 cm x 16 cm |

| ISBN: | 0-224-03509-6 |

| Megjegyzés: | Fekete-fehér fotókkal. |

naponta értesítjük a beérkező friss

kiadványokról

naponta értesítjük a beérkező friss

kiadványokról

Előszó

TovábbFülszöveg

'An important book a fascinating behind-the-scenes look at the firm which came to symbolize a decade of Wall Street excess.'

Bryan Burrough, co-author of Barbarians at the Gate

'Excellent one of the few books that a person can use to evaluate what happened in the financial

1980s. It should be required reading for everyone who got rich, lost a job, or watched in consternation as Wall Street's juggernaut swept the U.S. economy in the 1980s.'

Michael Lewis, author of Liar's Poter and The Money Culture

For more than a decade, Henry Kravis and George Roberts have been archetypes, first of Wall Street's boom years and then of its excesses. Their story and that of their firm, Kohlberg Kravis Roberts Co. - the bjggest, most successful, and most controversial participant in the age of leverage - illuminate an entire era of financial high jinks and speculative mania.

Kravis and Roberts wrote their way into the history books by concocting one giant takeover after another. Their... Tovább

Fülszöveg

'An important book a fascinating behind-the-scenes look at the firm which came to symbolize a decade of Wall Street excess.'

Bryan Burrough, co-author of Barbarians at the Gate

'Excellent one of the few books that a person can use to evaluate what happened in the financial

1980s. It should be required reading for everyone who got rich, lost a job, or watched in consternation as Wall Street's juggernaut swept the U.S. economy in the 1980s.'

Michael Lewis, author of Liar's Poter and The Money Culture

For more than a decade, Henry Kravis and George Roberts have been archetypes, first of Wall Street's boom years and then of its excesses. Their story and that of their firm, Kohlberg Kravis Roberts Co. - the bjggest, most successful, and most controversial participant in the age of leverage - illuminate an entire era of financial high jinks and speculative mania.

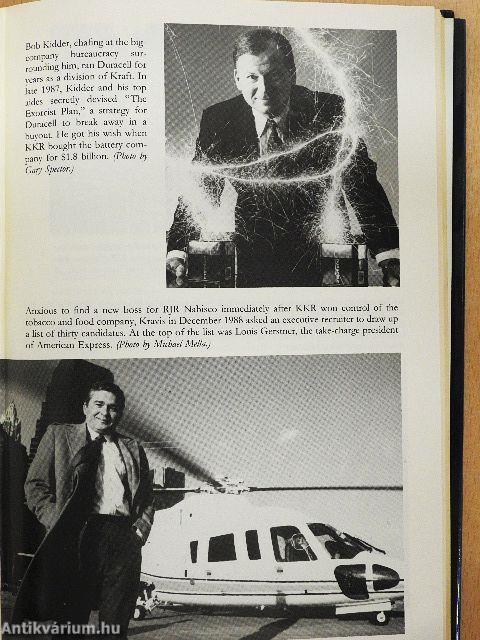

Kravis and Roberts wrote their way into the history books by concocting one giant takeover after another. Their technique: the leveraged buyout, an audacious way to acquire a company with borrowed money, borrowed management - and a lot of nerve. The boldest of these transactions, the purchase of RJR Nabisco for some $30 billion, was chronicled in the best-selling Barbarians at the Gate. But KKR, with a remarkably tiny cadre of only a half dozen partners and eleven associates, dominated the Wall Street scene in the late-1980s, acquiring one Fortune 500 company after another, including Safeway, Duracell, Motel 6, and others. That dominance allows the history of this single firm to tell the story of the undermining of the prudence of American businessmen and the fundamental soundness of the economy. Bankers and money managers stopped financing highways and factories and instead lent billions to KKR to pay for high-debt acquisitions. As companies then labored to pay off their debt loads, growth suffered, vital capital investments were deferred, and technological innovation was foreclosed. In short, the flirtation with daredevil debt silently took its toll on U.S. economic strength.

Merchiants of Debt shows how pride, jealousy, fear and ambition fueled Wall Street's debt mania - with consequences that affected hundreds of thousands of people. Vissza

Témakörök

- Közgazdaságtan > Pénzügy > Tőzsde

- Közgazdaságtan > Közgazdasági elméletek > Tőkés országok gazdasága

- Közgazdaságtan > Gazdaságtörténet > Tanulmányok

- Idegennyelv > Idegennyelvű könyvek > Angol > Szépirodalom > Megtörtént bűnügyek, dokumentumregények

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Pénzügy > Tőzsde

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Közgazdasági elméletek > Tőkés országok gazdasága

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Gazdaságtörténet > Tanulmányok

- Szépirodalom > Megtörtént bűnügyek, dokumentumregények